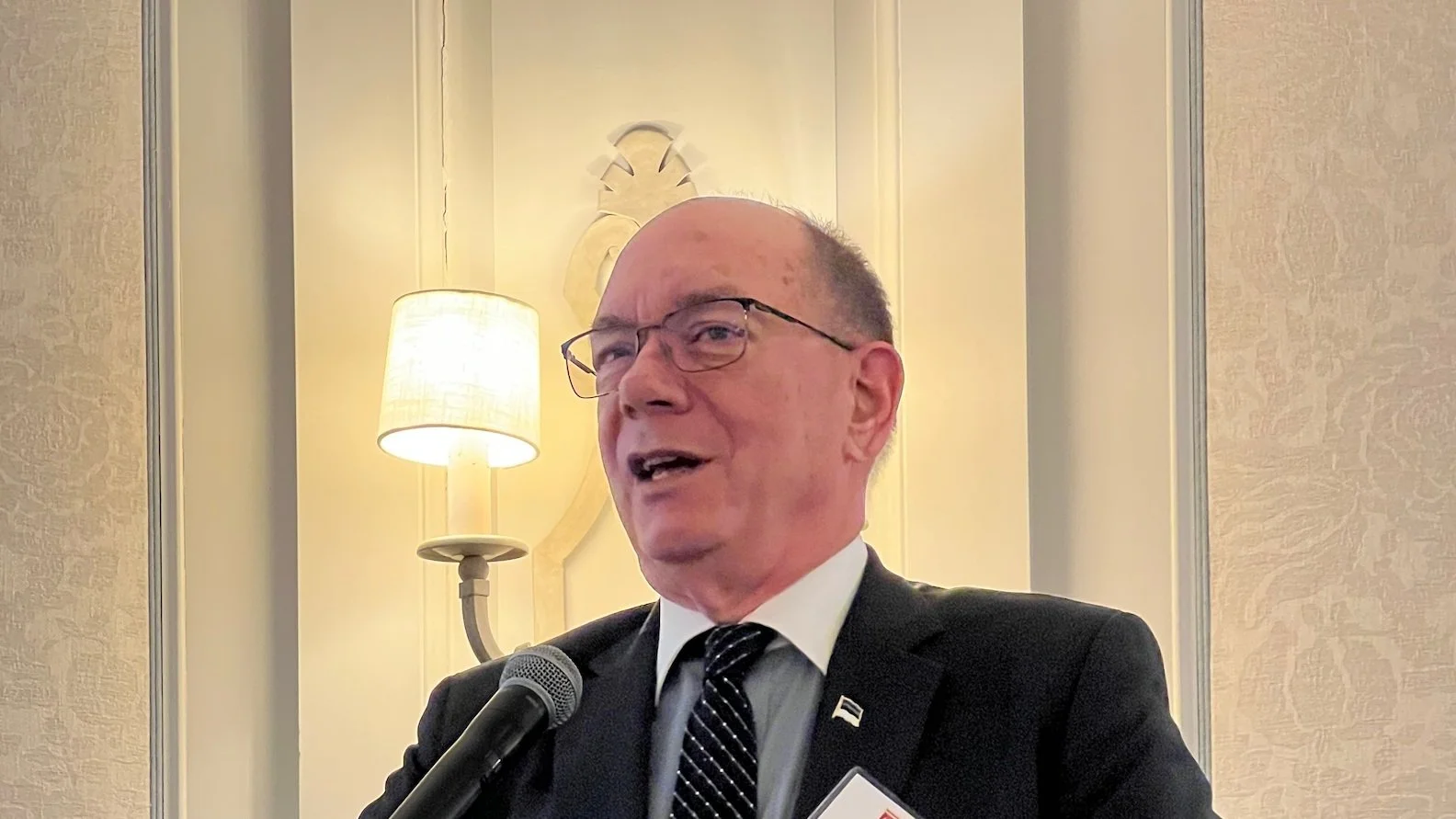

Dr. Chris Kuehl, managing director and co-founder of Armada Corporate Intelligence and the featured speaker at CCIM Kansas City's January breakfast on Friday, stated that the economy has “turned somewhat of a corner on inflation."

Kuehl said data indicates that the economy hit peak inflation in November/December of last year, and inflation is starting to come down.

“It’s still very high, so it’s not like it’s dancing in the streets time, but the CPI (Consumer Price Index) came out at 6.5 and it had been 9.2 at the beginning of last year. Wholesale and inflation dropped more than we thought it would. We just got reports in from Europe, and Germany’s inflation is down more than it should have been. So all of a sudden we’ve seem to have hit that mark,” he said.

Kuehl said there are factors indicating that inflation hit its peak, including a decline in commodity prices, a decline in the producer price index and a decline in shipping rates. In addition, the supply chain is starting to become a little more reliable.

“You have seen even consumer expectations relax,” said Kuehl.

Kuehl said that based on past patterns, once inflation hits its peak, we should start to see a reversal by the central banks on interest rate increases within the next seven to nine months.

“And this would mean that if this holds true, interest rates would start coming back down in the summer of this year and central banks would start to stimulate. It’s headed in the right direction, but not there yet,” he said.

Kuehl said corporate spending is still at record lows, related to many issues, including the breakdown of the supply chain and worker shortages.

Kuehl said corporations are spending their money on robotics and automation out of necessity.

“Even the smaller companies now are doing everything they can robotically because they can’t find anybody to work. They can’t find skilled people. If they do find them, they’re outrageously expensive, and as a result, even little companies do a lot of investing in robotics,” said Kuehl.

The fastest-growing sector for commercial construction in the United States—manufacturing—is being driven by the robotic revolution and reshoring. Last year the US saw $1 trillion of reshoring and should expect at least that amount this year, Kuehl said.

As manufacturers add robotics and automation, they must adjust their physical space.

“You may have been able to get away with some nasty cinder block, unairconditioned monstrosity for years when it just had people in it, but you put in the robot and the computers and they’re like this is disgusting. It’s hot and it’s dirty and we’re not going to work. . . .You’re seeing a lot of that,” he said.

Although the rise in reshoring began as a reaction to the supply chain, it is not likely to diminish, said Kuehl.

Kuehl said globally most companies are moving away from China. Kuehl noted that in December, only two of the 20 major producer markets had manufacturing sectors that were not in contraction—India and Mexico.

India is picking up what China is dropping. Manufacturing in Mexico has replaced oil as the number one driver of Mexico’s economy.

This part of the country will benefit from the reshoring phenomenon, particularly in light of the merger between Kansas City Southern and Canadian Pacific Railway.

“These two are going to create this north-south connection which heretofore has not existed. You’re connecting the manufacturing sector of Mexico,” Kuehl said.

With employers starting to demand that employees return to the office, office buildings are starting to get more popular. But, they tend to be smaller and located away from the city center and closer to where employees now work and live.

Kuehl said oil prices are falling and probably will continue to fall through most of this year. In addition, diesel prices are starting to decline because the United States is not sending as much to Europe.

Unemployment remains low, but Kuehl said it’s harder to compute unemployment rates than it used to be because there are so many different ways that people can make a living now. It’s difficult to count the gig economy workers using traditional household surveys because many gig workers say they don’t have a job when asked if anyone in the household is working.

“One of the downsides of the labor shortage means it’s gotten expensive. The number one way that people are hiring is by poaching each other. So if you’re poaching, you’re going to have to pay more to get them to jump ship, and the people who are being poached start paying their employees high enough so they don’t get poached. And once labor costs go up, they don’t go down,” said Kuehl.

Kuehl said that where employers are likely to find that next generation of skilled, educated workers is Africa, where half of the population is under age 30, and most of them are educated.

Kuehl predicts that we’ll see a mild turndown/recession, but not really a full-blown recession, for the first couple of quarters of this year before we start to bounce back.

_____________________________________________

FEATURE PHOTO: Dr. Chris Kuehl, managing director and co-founder of Armada Corporate Intelligence was the featured speaker at January’s breakfast hosted by CCIM Kansas City.